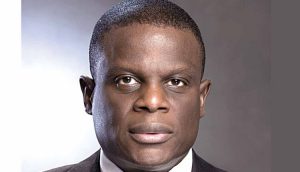

The sudden resignation of Olu Akanmu as the Chief Executive Officer of OPay has continued to brew concerns in several quarters.

It was reported that Olu Akanmu, a financial industrial veteran announced his resignation on Monday morning via his official Twitter handle calling for a need to do more to get more Nigerians financially included.

While Akanmu failed to state the reasons behind his sudden resignation, it came across as a shock given to many especially given that the fintech company is celebrating its 5th anniversary in Nigeria.

While thanking stakeholders that had supported him at OPay, Akanmu specifically challenged the fintech community in Nigeria to deepen financial inclusion.

According to him, collaborations, public-private partnerships, and more deliberate coordination at the digital public infrastructure ecosystem layers would be critical to ensure the fintech succeed in doing the next heavy lifting to extend the digital financial rail to the next 20 million.

Starting with gratitude to all who had supported him while he was the CEO of OPay, Akanmu said:

“My Gratitude to all my colleagues at Opay for the good work we did together in deepening financial inclusion in Nigeria, ensuring that fewer and fewer number of our people are left behind in partaking out of the opportunities of the digital financial system.

“Many thanks also to all our ecosystem partners and enablers who complimented us, without which we would not have been able to deliver on the lofty mission of OPay which is to “deepen financial inclusion through technology.

“Yet there is still so much to be done collectively by us as all to ensure that no one is left behind by the modern digital financial system.

“The lesson of the cashless or limited Cash period earlier in the year is that millions are not yet included despite the progress we have made collectively as an ecosystem.

“For the Nigeria Fintech community, the imperative of ensuring that we serve not only the banked and underserved, but also the completely excluded which still represents at least 45% of our people should be our collective and greater patriotic mission, complementing the historic efforts of traditional players.

“Collaborations, public-private partnerships, and more deliberate coordination at the digital public infrastructure (#dpi) ecosystem layers would be critical to ensure we succeed in doing the next heavy lifting to extend the digital financial rail to the next 20 million.”

Akanmu, a veteran industry professional and former executive director at FCMB, joined the Nigerian division of the Chinese-backed fintech in November 2021.

Under his watch, Opay saw impressive growth during Nigeria’s cash crunch, thanks to its distribution strategies and infrastructure.

Nairametrics reports that OPay Nigeria, which last unveiled a new logo to mark its 5th anniversary as it rebranded, said the change not only symbolized its significant growth and impact over the years but also represents its promise into a new era with enhanced services, technological advancements, and the aim to solidify its position as the most reliable financial platform in Nigeria.

ENigeria Newspaper

DailyrecordNg …Nigeria's hottest news blog

DailyrecordNg …Nigeria's hottest news blog