Nigeria’s foreign exchange reserves rose by 1.35 per cent to $435.8m month-on-month to end the month of May at $32.69bn compared to $32.25bn which it was on April 30, 204.

Analysis of the movement of reserves on the Central Bank of Nigeria’s database showed that reserves grew to a one-month high of $32,742,6bn as of May 23, 2024, but fell to $32.73bn the next day and $32.67bn on May 28, 2024.

Nigeria’s foreign reserves have been under pressure due to low revenues from crude oil proceeds which constitutes over 80 per cent of Nigeria’s foreign exchange earnings from exports.

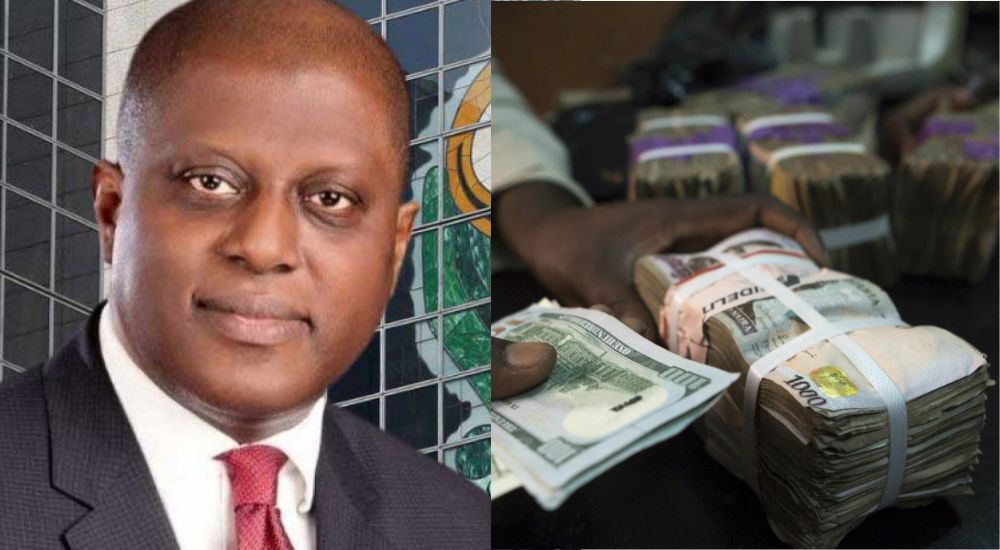

Although the apex bank governor, Olayemi Cardoso had denied using forex reserves to defend the currency, both the foreign exchange reserves and the naira have been under severe pressure.

However, the CBN hopes to shore up reserves with remittances which is indicative of the apex bank’s recent approval of licenses of fourteen (14) international Money Transfer operators (IMTOs).

Last month, the naira dropped from N1,330.2 per dollar on April 30, 2024, to N1,475.19 in May, according to data from the apex bank.

This represents a 10.9 per cent decline month-on-month, THE WHISTLER can confirm.

The fall is coming despite policies by the CBN to maintain foreign exchange stability in the country.

At the Black-market segment of the Nigerian Foreign Exchange Market, the naira closed at N1,490 per dollar despite central bank clampdown on forex dealers.

“There is a need to address the volatility in the foreign exchange market. Frequent swings in the exchange rate are very detrimental to business because of the uncertainty that comes with it,” the Chief Executive Officer of the Centre for the Promotion of Private Enterprises said in a response to THE WHISTLER.

DailyrecordNg …Nigeria's hottest news blog

DailyrecordNg …Nigeria's hottest news blog