Nigerian commercial banks have set withdrawal limits on their automated teller machines (ATMs).

Findings also showed the limits vary across banks.

This followed reported cases of cash scarcity in some parts of the country in the second half of last year.

On November 2, 2023, the Central Bank of Nigeria (CBN) said the scarcity experienced in some locations was due to a high volume of withdrawals from its branches by banks and panic withdrawals by customers from ATMs.

The CBN also said there was sufficient stock of currency notes for economic activities in Nigeria and assured its branches across the country were working to ensure seamless cash circulation in their respective states of operation.

While the scarcity persisted, the apex bank, on December 13, blamed the situation on hoarding, stating most of the cash given to banks was in the hands of individuals.

A year before, the CBN had attempted to limit cash circulation by implementing a cap on ATM withdrawals, to encourage cashless transactions.

The CBN reduced ATM withdrawals on December 6, 2022, to N20,000 daily and N100,000 per week. However, on December 21 of the same year, the regulator reviewed the cash withdrawal limits across all channels to N500,000 and N5,000,000 per week for individual and corporate organisations, respectively — after a public outburst.

This took effect on January 9, 2023.

However, recent findings across various locations in Lagos showed that banks have restored limits on ATM withdrawals.

TheCable gathered the cap set on account holders also restricts the customers to a certain amount should they attempt to withdraw from a different bank.

At three Guaranty Trust Bank (GTB) branches located in Ogba, Egbeda, and Fagba in Lagos state, the company’s account holders are only allowed to withdraw N20,000 per day at the ATM, while it dispenses a maximum of N5,000 to non-customers daily.

However, another GTBank in Egbeda has a daily cap of N50,000 for customers and N20,000 for non-customers.

Also, Polaris Bank branches at Festac and Ikeja have N50,000 ATM withdrawal limit per day for the lender’s account holders — but non-customers can only withdraw N20,000 per day.

At Union Bank branches in Ikeja, Ilupeju, and Berger, account holders can withdraw N20,000, N60,000 to N70,000, and N70,000 per day, respectively.

For Ecobank account holders, the maximum ATM withdrawal at its branches in Ogba and Berger is N400,000 and N40,000 per day, respectively, while non-customers can withdraw N20,000 daily.

The withdrawal limit for Zenith Bank account holders is N100,000 per day at ATMs located at the company’s branches in Aguda and Festac, but non-customers can only withdraw N30,000 and N50,000, respectively.

At its branches in Allen and Akowonjo, First City Monument Bank (FCMB) has an ATM withdrawal cap of N40,000 for account holders, while N20,000 is dispensed to non-customers per day.

Also, Sterling Bank branches at Ilupeju and Allen have a limit of N50,000 for account holders, but the maximum non-customers can withdraw are N25,000 and N50,000, respectively.

Access Bank also has a limit on ATM withdrawals, as the company’s branches in Allen and Ogba offer N40,000 per day to account holders, but dispense N20,000 to N25,000 to non-customers.

Checks at Fidelity Bank’s branches in Ilupeju and Aguda showed account holders can withdraw a maximum of N40,000 — but for non-customers at the Ilupeju office, the amount depends on the bank they are using, while for the Aguda branch, non-customers can withdraw N20,000 or until they can no longer take out funds from the ATM.

First Bank of Nigeria (FBN) also limited account holders’ ATM withdrawals to N40,000 daily, according to findings at its branches in Allen and Berger.

Although non-customers can withdraw N20,000 at FBN’s Allen office, withdrawal at the Berger branch depends on the bank used by non-customers.

For Globus Bank account holders, ATMs at the company’s branches in Ilupeju and Allen have a limit of N150,000 per day, however, non-customers withdrawal limit also depends on their banks.

Providus Bank branches in Allen and Adeola Odeku offer account holders a maximum of N100,000 and N150,000 (respectively) per day, with the ATMs dispensing N20,000 to non-customers daily.

However, account holders of Premium Trust Bank can withdraw N40,000 daily at the company’s ATMs in Allen and Adeola Hopewell branches but non-customers are only able to withdraw N10,000 and N40,000 to N50,000 per day, respectively.

At Allen and Mowe (Ogun state), ATMs in Unity Bank branches dispense N40,000 per day to account holders and non-customers.

But at Parallex Bank in Adeola Hopewell, the ATM withdrawal limit for account holders is N100,000, while that of non-customers depends on their banks.

Heritage Bank in Ilupeju has a cap of N150,000-N200,000 per day for account holders, but non-customers cannot withdraw more than N40,000 daily.

Also, findings at Suntrust Bank, located in Sanusi Fafunwa, showed account holders are limited to N20,000 a day and non-customers can withdraw N20,000-N30,000 daily.

At Titan Trust Bank in Egbeda, both account holders and non-customers are unable to withdraw more than N20,000 per day.

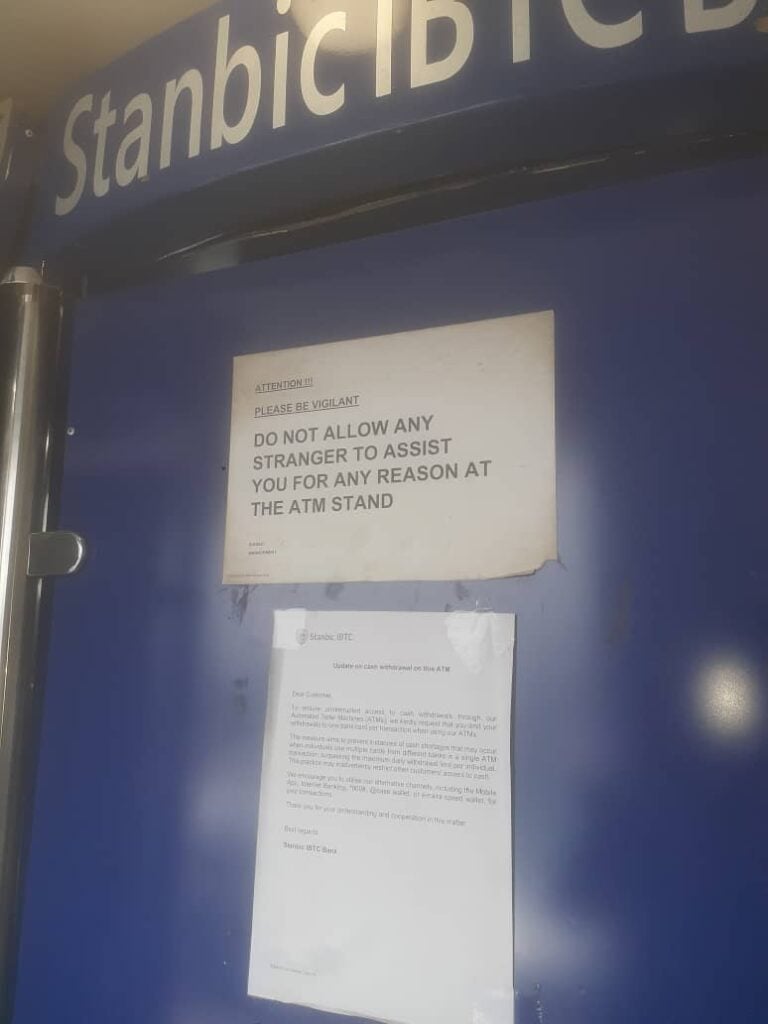

It is different at Stanbic IBTC in Computer Village and Ogba, where ATM withdrawal for account holders is capped at N80,000 to N100,000 daily.

However, non-customers can withdraw N40,000 daily at the Computer Village branch, while they can withdraw until they are unable to at the Ogba office.

TheCable also learnt that ATMs at Wema Bank branches in Oba Akran and Ojodu are dispensing N40,000 to account holders daily, but non-customers limit depends on their banks.

WHY BANKS ARE SETTING LIMITS TO ATM WITHDRAWAL

In a notice to customers seen , Stanbic IBTC Bank advised withdrawals should be limited to one bank card per transaction when using the company’s ATM to avoid cash shortage.

In the statement, pasted at its ATM gallery, Stanbic IBTC said cash shortage occurs when individuals use multiple cards from different banks in a single ATM transaction.

“To ensure uninterrupted access to cash withdrawals through our Automated Teller Machines (ATMs), we kindly request that you limit your withdrawals to one bank card per transaction when using our ATMs,” Stanbic IBTC said.

“This measure aims to prevent instances of cash shortages that may occur when individuals use multiple cards from different banks in a single ATM transaction, surpassing the maximum daily withdrawal limit per individual. This practice may inadvertently restrict other customers’ access to cash.”

Also, a top official in the banking industry — with knowledge of the withdrawal limits adopted by the banks — said financial technology (Fintechs) firms are one of the reasons banks are limiting withdrawal at their ATMs.

Speaking on condition of anonymity, he said fintech companies have no ATMs but offer their customers debit cards to withdraw all the cash from banks’ ATMs.

“They give cards to people. Most of the people that are doing POS, they go to commercial banks to go and clean out all the money in their ATMs, denying the real customers of the banks to have access to the cash that are in the ATM,” he said.

The source told TheCable point of sale (POS) operators thereafter charge bank customers in need of the cash POS operators withdrew from the ATMs.

He said banks had to become creative to tackle the issue.

In a statement to TheCable, Access Bank said every bank “sets ATM withdrawal limits based on available ‘ATM fit’ cash and the number of ATMs for the bank as well as the needs of the customers”.

Commenting on the disparity in limit for its account holders and non-customers, Access Bank said the former are prioritised.

“It is important for us to give priority to our customers cash need; we owe them that duty. Subject to cash availability we can allow other banks’ card holders to also access cash,” Access Bank said.

“Every bank issuing cards is expected to also deploy ATMs to match the need of her customers.”

When asked if the CBN approved the limit, Access Bank said every financial institution has the right to set its withdrawal cap which may change from time to time subject to cash availability, among other things.

However, Access Bank acknowledged CBN had issued a directive that the maximum cash withdrawal limit on all channels is N500,000 weekly for individuals.

Meanwhile, the ATM withdrawal restrictions — as observed by TheCable — violate the limits set by Nigeria’s financial regulator.

When contacted on February 12, Hakama Sidi Ali, CBN’s acting director of corporate communications, requested the enquiry be sent to her WhatsApp. The following day, she asked for the locations of the banks for an independent investigation.

Since the disclosure of the banks’ locations, CBN has not responded to questions on the matter despite several calls, and WhatsApp messages to the regulator’s spokesperson.

DailyrecordNg …Nigeria's hottest news blog

DailyrecordNg …Nigeria's hottest news blog