Being resilient, having multiple streams of income, and building emergency funds, have been identified as key attributes of an individual on their way to financial security.

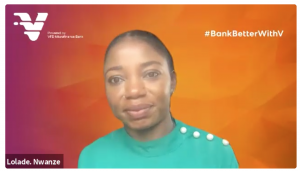

This formed part of the submissions made by Tosin Olaseinde, Founder/CEO of Money Africa, at a special Grow With V webinar, themed, ‘What Does Your Half-Year Finance Report Say?,’ organized by banking app of the year 2020, VBank. The one-hour conversation was anchored by the Public Relations & Communications Manager for VFD Group, Lolade Nwanze.

The Financial Literacy expert reiterated that Personal Finance is a long-term project which mostly requires the right mindset, at 80 per cent, to succeed, and only 20 per cent of knowledge. While fielding questions from the participants and anchor, she encouraged participants to start saving now in order to have a better financial second half report.

‘’ The first step to financial independence is planning; what you don’t track you can’t follow through with. Emergency Fund is extremely important. How much Emergency Fund do you have? Start thinking about being resilient; think of what to fall back on and how many streams of income to create. You don’t look for money when you need it, you start to look for it before you need it,’’ she said.

She noted that investing in interest-yielding platforms is far better than putting one’s money in the traditional rotating savings and loans systems popularly called ‘ajo’ or ‘esusu.’ The CEO described the latter as inefficient and warned against ponzi schemes while stressing that compounding and time remain the best partners for financial growth.

Advising on what to invest in, Tosin said: ‘’Hedge your money by investing in stable currencies. When thinking of where to invest, think stocks, bonds, hedge funds, private capital etc. Remember that preservation of capital is better than high rewards when considering high risk ventures. Plan, reevaluate, benchmark and don’t stop tracking.”

Grow With V is a monthly webinar session that brings subject experts in different knowledge areas into the same virtual room with young individuals, professionals and SMEs. In the past, it has featured Noble Igwe, Mai Atafo and popular Instagram store owner, Maureen Edwin. In this second half of the year, VBank is partnering individuals and businesses to help grow their finances via a Personal Finance series which has kicked off with financial literacy expert, Tosin Olaseinde.

VBank is a digital banking platform that allows individuals to set up a full-fledged banking account in two minutes and provides products like Fixed Deposit, Loans and Target Savings as well as a budgeting feature to encourage tracking and accountability. It is available on the play and app stores as V by VFD.

DailyrecordNg …Nigeria's hottest news blog

DailyrecordNg …Nigeria's hottest news blog