James Emejo in Abuja

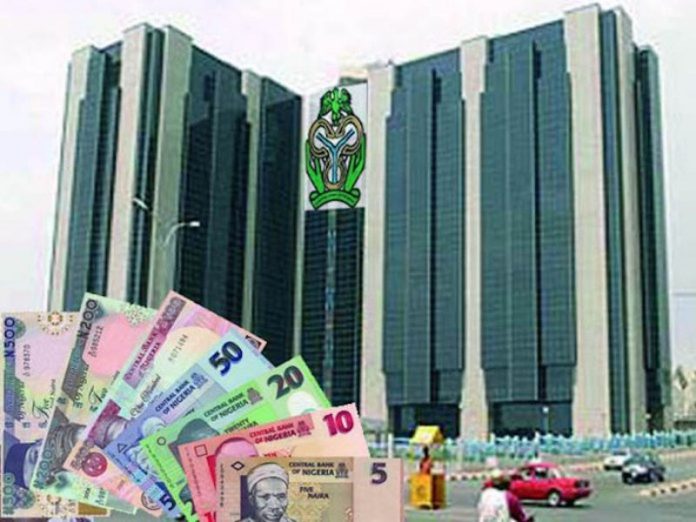

The Central Bank of Nigeria (CBN) Tuesday warned that the country’s recently celebrated exit from recession may be under threat in view of the slowed growth in Gross Domestic Product (GDP), which declined to 1.50 per cent in the second quarter from 1.95 percent in the first quarter of the year.

It further expressed concerns that the modest stability so far achieved in key indicators, including inflation, exchange rate and reserves since its last Monetary Policy Committee (MPC) meeting in July- also appeared to be under threat of reversal given the new data, which provided evidence of weakening macro-economic fundamentals.

Addressing journalists at the end of the two-day meeting of the MPC in Abuja, CBN Governor, Mr. Godwin Emefiele, who read the committee’s communique, urged the fiscal authorities to sustain the implementation of the 2018 budget to relieve the supply side growth constraints as well as address the flooding incidents, which have become perennial on a permanent basis.

This is as the CBN also resolved to retain the Monetary Policy Rate (MPR), otherwise known as interest rate, at 14 percent and further left the Cash Reserve Requirement (CRR) unchanged at 22.5 per cent and Liquidity Ratio at 30 percent.

The MPR is the rate at which the CBN lend to commercial banks and often determines the cost of borrowing.

Emefiele said the implementation of the 2018 budget, the improvement in the security situation as well as sustained stability in the foreign exchange market will stabilise prices and strengthen economic growth.

He said the committee believed, however, that accretion to the external reserves should strengthen the last quarter of 2018 with crude oil prices remaining above the budget benchmark price of $51 per barrel and oil production increasing to 2.23 million barrels per day.

The apex bank also urged the government to take advantage of the rebound in oil prices to strengthen the fiscal buffers.

It noted that the committee had two choices of either tightening monetary policy or maintaining it at current levels.

He said seven of the 10 members voted to retain the MPR at 14 percent while three of the seven members also voted in favour of raising the CRR.

However, the CBN further expressed grave concerns over that late implementation of the 2018 budget, weakening demand and consumer spending, build-up in contractor debt and low minimum wage.

Other areas of concern include the impact of flooding on agricultural output and other economic activities, continuing security challenges across north east and north central zones and growing level of sovereign debts.

Emefiele also seized the opportunity to clarify some misconception in the CBN’s recent takeover of Skye Bank and as well as the decision to change its name to Polaris Bank, citing legal requirement.

He said, “Let me again repeat that the strategic health of the Nigerian banking industry remains sound; and I will put it by saying that in every chain, there’ll always be strong points and weak points in a chain; and we would love to see is to continue to ensure that chain remains strong in all aspects of it.

“But notwithstanding that, as we see areas where there’s weakness, well do everything possible to make sure that we keep the chain linked together. And that’s what we are doing as much as possible.”

He added, “I will love to see a situation where banks are not liquidated, that we have to think outside the box to see to how we can ensure that we have more banks in the country, rather than have less banks in the country. And that’s what we are doing.

“Of course, the situation with Skye Bank as we all know is that as at two years ago when the news broke, the bank has slide into negative capital as a result of Non-performing loans.

“At that time, we compelled the entire board and the executive management to resign and they did and left. At that point, before we conducted the forensic audit, the hole was about N370 billion; after the forensic audit, it came to the level that it is right now which is close to about N800 billion.”

Continuing, Emefiele said, “And what we decided to do is to say, that having established the hole at this level, and that if tax payers’ monies would be invested in this company or bank, in this case though as a loan, that there’s a need to let shareholders know, particularly those we considered as prominent and important shareholders that they’ve lost their investments.

“We will try just as we’ve done in say depositors’ to make sure that small investors remain protected under some arrangement but notwithstanding that fact that their holdings will be substantially whittled down.

“But we’re trying to say that- and it goes to the issue of why did you give it a sexy name instead of leaving it with the name it was before?

“The name had to be changed for legal reasons, having gotten to a point where the CBN and government has invested close to N800 billion in this bank; at some point, it must be seen to be owned by the CBN until we find investor that can pay a fair value price for this enterprise. That’s the compelling reason the name had to change.”

The governor further dispelled insinuation that Polaris Bank was not a registered company at the time of the transaction.

He said, “Insinuations that the company wasn’t registered is false. It was first registered as a limited liability company a few weeks ago and was registered as a bank a day before we took that action.

“I’ve seen some of the documentation that people were circulating because they went to the internet to check…It’s important for us to note that servers may indeed not be updated and if that server they are looking at is not updated, it doesn’t mean that this bank was not incorporated.”

He said, “I think we should just ignore those kinds of sentiment and let’s focus on the real issues which had to do with that we are embarking on a journey to keep a bank alive, to protect depositors’ monies and also ensure that we don’t throw over 5,000 staff of that bank into the labour market.”

Also, providing update on efforts being made to resolve the MTN forex infraction issue involving some banks, Emefiele submitted that the CBN is currently engaging with them to afford them opportunity for fair hearing.

He predicted that the outcome of the engagement will leave all parties satisfied.

He said, “First, it’s important for us to know that the fine- $8.1 billion is dollar equivalent of MTN’s naira generated from their profit. So I will neither call it a fine or a penalty.

“What CBN sought by asking MTN to return that money is that we want a reversal of that transaction because it was not finally authorised by the CBN and that’s what we sought to do.

“And because those funds moved through these four banks, the quantum of dollar that passed through the banks was what we said the banks needed to remit back or the company needed to remit back to CBN through the banks.

“It didn’t mean that these were the banks’ obligation and we understand that there were some interpretations in some quarters that aside from the naira penalty, that there were some conclusions that those dollars attributed to have been remitted by these banks on behalf of this company were indeed the liabilities of the banks. And that’s the reason we provided a clarification to the banks when they called us that that liability is indeed that of MTN and not theirs: and that CBN was not in any position or in any way going to debit the banks for the dollar because it was not and it’s not meant to be their liability.”

According to him, “It’s important to know that this was an investigation that started over two years ago; there were a number of issues; about two of the issues we’ve decided to allow it a dispensation to say let it go.

“But on this last one, we thought the amount was large and that there’s a need for us to subject this to further investigation and discussions.

“Yes, I feel vindicated that in the history of the banking industry, at least I gave a chance where the regulator- governor sitting in the meeting, deputy governors, director of banking supervision and over 20 examiners sitting in a hall with a company and the banks, asking them to resolve the issues because we admit that MTN is a systemically important telecom company in Nigeria.

“And after that meeting we held on May 25, 2018, the discussion was inconclusive- we gave the company and the banks one week which was meant to be end of May; it was not done but also realising the importance of this company so that we will not jolt the system, we gave almost extra two months for them to provide relevant documentation to the examiners so they can knock those items out of their outstanding item.

“Unfortunately, this didn’t happen and we felt that we couldn’t wait indefinitely. And that was the reason we released the investigation report to the banks and the company.”

He said: “They’ve now responded and provided documents which I have sent down to examiners to now begin to review. And I repeat; we will go through the pain again to invite the banks and invite the company to prove their case because it’s just normal that we should allow these company and the banks to clear themselves.

“That’s what we are doing and I believe in due course, we should make a final call on this subject. And it’s important for me to say and repeat at this meeting that the sanctity of our CCIs remain sacrosanct; at a time CCIs were being issued by CBN but in order to provide a transparent system, we migrated the process to banks issuing the CCI.

“Today, we’ve migrated this into what we call the electronic CCIs- so that tells you how transparent we are on this subject. And I repeat, the sanctity of CCIs remain sacrosanct; we’ll respect CCIs but again, it’s important that people should please as much as possible ensure that they do what’s right, obey the extant laws and foreign exchange regulations of our country.

“We will resolve this matter; I’m very optimistic we’ll resolve the matter and I believe that everybody will be happy: MTN will be happy, the banks will be happy and CBN and government will be happy.”

DailyrecordNg …Nigeria's hottest news blog

DailyrecordNg …Nigeria's hottest news blog