The abrupt collapse of one of Nigeria’s foremost commercial banks, Afribank Nigeria Plc, is not unconnected to mismanagement, crime and alleged fraud. The French investors’ bank was established in 1959 and operated as commercial bank, real estate, and insurance broker. It had over 250 branches nationwide and rated in Nigeria’s “first four” until 2009 when the biggest financial heist was discovered among its top management executives, bulk of the reason the bank failed recapitalisation deadline issued by the Central Bank of Nigeria that year.

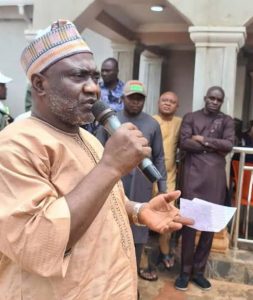

First in the list was the executive director, Treasury and Financial Institutions, Public Sector/Transaction Services, and Corporate Support, Mr Jibrin Isah, now the senator representing Kogi East senatorial district. Isah was dismissed from AfriBank in 2009 for alleged financial malpractices, frauds, and economic crimes.

Following his dismissal, Jibrin was arrested along with Mr. Sebastian Adigwe, Mr Chinedu Onyia, Mr Henry Arogundade, Mr Peter Ololo, Falcon Securities ltd, Osa Osunde, Isa Zailani and charged for financial malpractices, fraud, and Economic crime.

Thereafter a 36-count charge bordering on theft and alleged wrongful conversion of millions of shares belonging to Afribank Plc, valued at N87 billion were brought against the former Chief Executive Officer of the bank, Mr Sebastian Adigwe, Jibrin Isah, Mr Chinedu Onyia, Mr Henry Arogundade, Mr Peter Ololo, Osa Osunde and Isa Zailani who were ordered by Justice Olabisi Akinlade to be remanded in Economic and Financial Crimes Commission, EFCC, custody by an Ikeja High Court. They were accused of conspiracy, receiving stolen property and stealing the sum of N87 billion belonging to Afribank and were subsequently docked. The accused persons were alleged to have stolen the money which was fraudulently converted to the use of AIL Securities Limited, Asset Management Nominees Holding Limited and Falcons Securities Limited belonging to them.

It was a brazing and audacious criminal act to what transcend the modern-day stealing of the Nation’s resources by public office holders. No bank would have survived with such humongous amount of money unaccounted for.

However, Senator Jibrin Isah and co were arraigned, but, to the consternation of everyone, Echocho was made a third witness against his fellow culprits despite palpably indicting evidences not minding that as the bank’s treasurer the responsibility of portfolio (liquidity, capital efficiency/adequacy and yield) management, trading/hedging, asset liability management and funds transfer pricing were all his; ironically, it was on all these premises that the bank was liquidated. Clearly. it was a high-level conspiracy and scheme abetted by the sleight hand of the relevant authorities. Subsequently, Echocho was never seen in court again while Farida Waziri’s Economic and financial Crimes commission played ‘the blind eye’ with spurious claims that Jibrin was nowhere to be found.

It is rather unfortunate, Nigerians play to the gallery of victims of bad leadership, wherein they are either conscious or indeliberate accomplices. Jibrin Isah courtesy of the position he occupied in the defunct AfriBank played the lead role in insolvency, illiquidity and mismanagement of the institution leading to its unavoidable collapse. But how he bought justice over reducing Waziri’s EFCC to a mocking reference left much to be desired. The U.S global watch was the first to react to the anti-graft agency’s loss of credibility and huge dent on Nigeria’s fight against corruption. And though, Waziri was later dismissed, the EFCC has existed at the whims and caprices of corrupt public and private corporate officials as the case of Afribank enunciates.

For a better understanding of Isah’s alleged shady deals in AfriBank, the petition written by an Abuja based Lawyer, Barrister Kayode Ajulo to the EFCC on the 30th of May 2012 is a veritable reference material:

“PETITION ON BEHALF OF MR. GBOLAHAN PETERS AND AHMED IBRAHIM AGAINST FORMER EXECUTIVE DIRECTOR OF AFRIBANK, ALHAJI JUBRIN ISAH OF CONSPIRACY, FINANCIAL MALPRACTICES & ECONOMIC CRIMES. REQUEST FOR PROSECUTION OF ALHAJI JUBRIN ISAH

We write as Solicitors to Mr. Gbolahan Peters and Alhaji Ahmed O. Ibrahim of Forum for Zero Tolerance to Financial Crimes, Abuja (hereafter referred to as your Petitioners) and wish to draw your attention to the criminal indictment against Mr. Jubrin Isah the erstwhile Executive Director of Afribank Nigeria Plc and the seemingly conspiracy by your Commission under the leadership of your predecessor to bringing him to justice.

Mr. Jubrin Isah, (herein after referred to as the Suspect) was the Executive Director of Afribank Nigeria Plc, who was disengaged through the dissolution of Executive Management team of some Banks in August, 2009, over financial malpractices and mismanagement of the Afribank Nigeria Plc.

Sequel to the dissolution, the Suspect was arrested and severally investigated subsequently upon which he was indicted and first arraigned with Sebastian Adigwe, Osa Osunde, Isa Zailani, Chinedu Onyia, Henry Arogundade, Falcon Securities Ltd, and Peter Ololo before the Federal High Court, Lagos with Charge No. FHC/L/294/09.

Moreover, in the Amended Charges filed of 13th April, 2010, the 33 amended count charges against the Suspect and others revealed that the Suspect and others mismanaged and thereby committed a financial crimes to the total tune of over 60 Billion contrary the Failed Banks (Recovery of Debts) and Financial Malpractices in Banks Act Cap. F2 Laws of the Federation of Nigeria, 2004, the Banks and Other Financial Institutions Act and the Investments & Securities Act.

The Suspect and his co-accused were also arraigned before the High Court of Lagos State, Ikeja in May 2011 with Charge No. 10/160C/2011 However, to the consternation of your Petitioners and in what can only be depicted as a scheme and official conspiracy, all the charges against the Suspect were dropped while the prosecution team turned him to prosecution witness without any justification.

We wish to note that your Petitioners’ apprehension is not unfounded as the followings justified their fear:

1. During the Suspect’s initial criminal trial at Federal High Court, Lagos, in 2009, the Suspect, though was charged as co-accused was never brought before the court but was busy campaigning to become Peoples Democratic Party flag bearer in Kogi State, while your Commission under the leadership of your predecessor, Mrs. Farida Waziri maintained that the Suspect is nowhere to be found.

2. The Suspect by the summary of the charges, facts and circumstances of his indictment was not only the Executive Director of AfriBank Nigeria Plc, but by his admission in his statement made to your Commission, was in charge of Investment Banking, covering Treasury, Financial Institution, Federal Public Sector, Private Banking, E-Solution and Corporate Support, thereby making him to played the leading role in the offences charged.

3. Instances abound in the trial where other accused have queried your Commission’s decision to make the Suspect, your witness instead a co-accused considering the enormity of his indictments.

4. All the transactions of the Banking and Financial malpractices which formed the indictments of the Suspect and others were well documented of which his indicted as the principal accused person and thereby made him being turned to prosecution witness defective.

5. The absence of the principal accused person in the trial as co-accused would spell doom for the prosecution of the charge.

Against this background, our extant brief is to ask you to use your good offices to review the decision of your predecessors, and ensure that the Suspect is brought to book for his liabilities in the financial malpractices and economic crimes.

You are no doubt aware that it is now an established fact within and outside the shore of Nigeria that the bane of Nigeria under-development is as a result of economic crimes in public and private sectors.

This fact is very compelling that it lead to the establishment of your Commission to effectively tackle and curb the trend. No doubt, you are also aware that your Commission’s glooming public perception in fighting the economic crimes is not unconnected with your Commission’s wittingly and/or unwittingly insincerity and seemingly lack of will to prosecute those who have been apparently indicted like in the case of the suspect.

Your Petitioners cannot therefore allow this obvious inequality without it been addressed and it is in the circumstance of the foregoing that your petitioners in consideration of Section 24 of the Constitution of the Federal Republic of Nigeria 1999 (as amended) and other enabling laws in Nigeria request your quick review of the indictments and prosecution of Alhaji Jubrin Isah for the purpose of bringing him to book for financial malpractices and economic crimes perpetrated while serving as Executive Director of Afribank Nigeria Plc.

TAKE NOTICE that if by 7th June, 2012 no practical steps and demonstration of good faith to bring Alhaji Jubrin Isah to book is taken, we shall without further notice, set in motion, machinery of justice to compel you to do same.

It is our firm confidence that by your Commission’s claims that no one is above the law, you will not hesitate to investigate the above allegation and bring the culprit to book.

Thanks for your mutual belief in the supremacy of the rule of law. Accept, please, the firm assurances of our highest regards.

Yours truly,

Pp: KAYODE AJULO & CO. CASTLE OF LAW.

Z. A. BABAH, ESQ. Ag. Head of Chambers

Omolola AWOLOLA, ESQ. Counsel

c.c.:

1. President of Federal Republic of Nigeria, Abuja;

2. Hon. Attorney-General of the Federation, Abuja;

3. Secretary to the Government of Federation, Abuja.”

It has been thirteen years since Jibrin Isah and his accomplices allegedly destroyed one of Nigeria’s finest financial institutions and thirteen years since the criminal trial of those who superintended the collapse of the bank. But as is the case with some of Nigeria’s criminal trials, the issue of Afribank has seemingly gathered dust in the shelves of the EFCC and the Nigerian judiciary while some of the shareholders and depositors of the banks who are lucky to be alive watch-on while those responsible enjoy the loot, occasionally brazenly.

DailyrecordNg …Nigeria's hottest news blog

DailyrecordNg …Nigeria's hottest news blog