…Crashes Price Of Dollar To N1,313

The Central Bank of Nigeria has instructed Bureau de Change sellers not to sell above one per cent of the above purchase rate from the $20,000 weekly interventionwhich it has reintroduced.

We had reported that the apex bank will resume its weekly intervention to BDCs due to the crash in the naira.

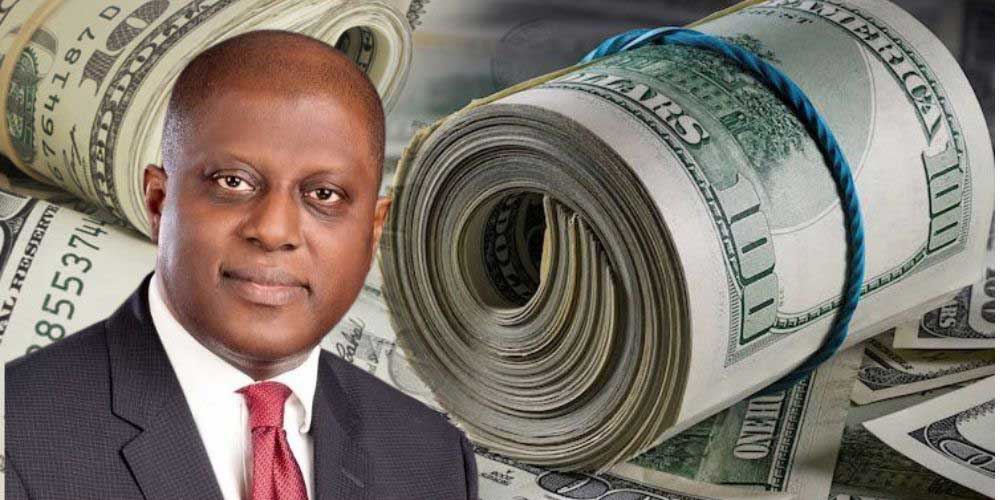

In a circular dated February 27, 2024 with reference number TED/DIR/CON/GOM/001/066, signed by CBN’s Director, Trade & Exchange Department, Dr. Hassan Mahmud and obtained, the bank told operators that it has approved $20,000 weekly sale.

The circular was titled, ‘Sale of Foreign Exchange To Bureau De Change Operators To Meet Retail Demand For Eligible Invisible Transactions.’

The list obtained reveals that only 785 qualified for the intervention out of the 5,691 BDCs approved by the CBN.

The circular said, “The CBN has approved the sale of foreign exchange to eligible Bureau De Change (BDCs) to meet the demand for invisible transactions. The sum of $20.000 is to be sold to each BDC at the rate of N1,301/S – (representing the lower band rate of executed spot transactions at NAFEM for the previous trading day. as at today. 27th February 2024).

“All eligible BDCs are directed to make the Naira payment to the designated CBN Foreign Currency Deposit Naira Accounts and submit confirmation of payment, with other necessary documentations, for disbursement at the appropriate CBN Branches – Abuja, Awka, Lagos and Kano).”

The CBN said it observed the continued price distortions at the retail end of the market, which is feeding into the parallel market and further widening the exchange rate premium.

On the disbursement guideline, the CBN said “All BDCs allocated Foreign Exchange, shall keep records of beneficiaries and amount sold to each beneficiary.

“BDCs shall not sell more than $4,000 per individual for PTA and $5,000 for BTA. All BDCs allocated Foreign Exchange shall not re-sell at more than 1% spread to end users. All BDCs shall display their buying and selling rate at their outlet. All BDCs transaction shall be conducted in designated approve BDCs office/outlet addresses. Street hawking is strictly prohibited.

“All BDCs allocated foreign exchange, shall make daily rendition of the sale of foreign exchange to end user before 10am the next business day on the Financial Institutions Foreign Exchange Reporting System (FIFX) portal.

“The CBN examination team shall periodically conduct on the spot examination of Foreign Exchange disbursements by BDCs. BDCs are expected to maintain a high level of professionalism and transparency in the conduct of their business in line with stipulated guidelines. Any breach shall attract immediate revocation of the BDC license.”

THE WHISTLER

DailyrecordNg …Nigeria's hottest news blog

DailyrecordNg …Nigeria's hottest news blog