The Executive Chairman of the Federal Inland Revenue Service (FIRS), Mr. Babatunde Fowler, has said the federal government is processing court documents that will allow it sell properties of companies which have been evading taxes.

Speaking last Wednesday night on The Core, a Channels Television programme hosted by Kadaria Ahmed, Fowler said the N20 billion realised from the Voluntary Assets and Income Declaration Scheme (VAIDS) was paid by 262 people.

“We have identified properties worth N2 trillion that belong to corporate organisations that have never filed any tax and now we are in the process of getting a court order to start selling those properties if the owners do not come and pay the taxes,” the former Executive Chairman of Lagos Inland Revenue Service (LIRS) said.

He added: “And this is a programme we are going to roll out across the country and we’ve concluded in Kaduna and in Lagos, and we are going to other states.

“On the federal level, people have declared and paid N20 billion; and one thing I will let you know is that based on the experiences of other countries, usually, people wait till the last minute.

“In terms of applications received at the federal level, about 262 applications have been received. So far paid is N20 billion and people are still in the process of putting together their facts and in the next two or three weeks, the figures will be different.”

VAIDS offers a grace period of nine months from July 1, 2017, to March 31, 2018, for defaulters to voluntarily pay their taxes.

The government promises to waive penalties that should have been levied and the interest that should have been paid on overdue taxes.

Those who declare their tax obligations honestly will not be subjected to any investigation or tax audit after the grace period.

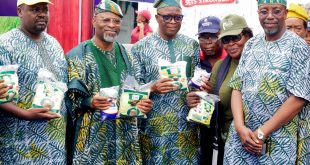

The programme also featured the Minister of Finance, Kemi Adeosun and other panelists.

Adeosun lamented the low tax compliance in the state, adding that there is no political undertone to the VAIDS programme.

She said an efficient tax system would ensure more revenue for the government.

DailyrecordNg …Nigeria's hottest news blog

DailyrecordNg …Nigeria's hottest news blog