- The FirstBank Digital Xperience Centre (DXC) in the University of Ibadan (U.I) is the Bank’s second fully automated self-service centre. The first DXC is at the Bank’s remodelled Adetokunbo Ademola branch, Victoria Island, Lagos.

- Furnished with the latest advancements in financial technology, it is one of the many ways the Bank reinvents itself to leave no stone unturned in exposing its customers to state-of-the-art and leading digital banking experience in the continent.

- It is a significant leap by the Bank to revolutionise the banking industry in the country, putting customers at an advantage in experiencing world-class innovative banking services, thereby exploring the future of banking firsthand.

First Bank of Nigeria Limited, Nigeria’s premier and leading financial inclusion services organisation, has announced the launch of its second fully automated branch, the FirstBank Digital Xperience Centre (DXC), on the campus of the University of Ibadan (U.I).

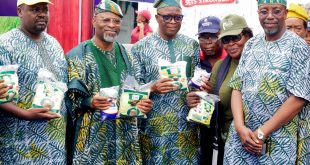

Professor. Kayode Adebowale, Vice Chancellor, University of Ibadan, Professor E.O Ayoola, Deputy Vice Chancellor Admin and Professor Aderonke Baiyeroju, Deputy Vice Chancellor, Academics led the university community in hosting the delegation from FirstBank comprising Dr. Adesola Adeduntan, CEO, FirstBank; Callistus Obetta, Group Executive, Technology & Innovation Services and Timothy Arowoogu, Group Head, Public Sector, West amongst others.

The DXC is a significant leap by FirstBank in revolutionizing the banking industry in the country as it is a state-of-the-art hub that puts customers at an advantage in experiencing world-class innovative banking services and explore the future of banking firsthand.

It is designed to cater to the growing and evolving needs of consumers and the banking public, enabling customers to navigate the digital landscape with confidence. The initiative aligns with the Bank’s commitment to delivering exceptional customer experiences and staying at the forefront of financial innovation.

Provided to put customers at an advantage in carrying out various activities on their own without interacting with anyone, the self-service branch is built with a wide range of phased modern banking facilities. These include humanoid robots equipped with Video Banking and Artificial Intelligence (AI), taking on the role of friendly branch staff; Teller Cash Recyclers (TCRs); Self-Service kiosks for non-financial transactions such as account updates; Fast Track (Contactless) ATMs; Interactive Smart Screen to ensure effective and comprehensive consultation with bank sales staff via remote video connection.

Other services include paperless/electronic forms designed to promote the timely resolution of complaints, dispensing of account statements and account enquiry/management, funds transfer, dispensing of new ATM cards; fixed deposit booking between N100,000.00 to N5,000,000.00, card services and management, cheque management, email and phone number update, ATM card and token block, amongst many others.

Expressing his delight at the initiative, Dr Adesola Adeduntan, CEO, FirstBank said ‘Our mantra, “Woven into the fabric of society”, summarises how we have proven our commitment to customers across all our footprints globally, by investing in modern technology infrastructure to pioneer digitisation of products and platforms, thereby giving our over 42 million customers convenient, seamless, safe and secure banking experience”.

“The FirstBank DXC is a fully automated interactive digital branch, the first of its kind in the Nigerian banking industry. It was first launched in Lagos, Nigeria in 2021 and has since then, redefined customers’ banking experience by introducing them to a new world of digitised self-services,” he said.

95% of customer-induced transactions on FirstBank’s digital channels are enjoyed by 22 million of its digital product users. The Bank processes over 12% of the industry payment volume in Nigeria.

FirstBank Digital Xperience Centre is a cutting-edge facility that reshapes the way customers interact with banking services, bringing an unparalleled level of convenience, efficiency, and innovation to their financial journeys.

Furnished with the latest advancements in financial technology, it is one of the many ways the Bank reinvents itself to leave no stone unturned in exposing its customers to state-of-the-art and leading digital banking experience in the continent. The Bank’s first Digital Xperience Centre was unveiled in 2021 at its remodelled Adetokunbo Ademola branch, Victoria Island.

The groundbreaking initiative is scheduled to hit other locations across the country’s geopolitical zones in the coming months.

About FirstBank

First Bank of Nigeria Limited (FirstBank) is the premier Bank in West Africa and the leading financial inclusion services provider in Nigeria for 129 years.

With over 750 business locations and over 215538 Banking Agents spread across 99% of the 774 Local Government Areas in Nigeria, FirstBank provides a comprehensive range of retail and corporate financial services to serve its over 42 million customers. The Bank has an international presence with subsidiaries operating in 9 other countries. These subsidiaries are FirstBank (UK) Limited in London and Paris, FirstBank in The Gambia, FirstBank in Sierra-Leone, FirstBank in the Republic of Congo, FirstBank in Guinea, FBNBank in Ghana, FBNBank in Senegal as well as a Representative Office in Beijing, China. The Bank is at the forefront of promoting digital banking in the country and has issued over 12 million cards, the first bank to achieve such a milestone.

FirstBank has continued to make significant investments in technology, innovation and transformation, and its cashless transaction drive has been steadily accentuated with almost 22 million active FirstBank customers signed up on digital channels including the USSD Quick Banking service through the nationally renowned *894# Banking code.

FirstBank’s commitment to Diversity is shown in its policies, partnerships and initiatives, such as its employees’ ratio of female to male (about 39%:61%; and 32% women in management) as well as the FirstBank Women Network, an initiative that seeks to address the gender gap and increase the participation of women at all levels within the organization.

In addition, the Bank’s membership of the UN Women is an affirmation of a deliberate policy that is consistent with UN Women’s Women Empowerment’s Principles – Equal Opportunity, Inclusion, and Nondiscrimination.

Since its establishment in 1894, FirstBank has consistently built relationships with customers focusing on the fundamentals of good corporate governance, strong liquidity, optimised risk management and leadership. Over the years, the Bank has led the financing of private investment in infrastructure development in the Nigerian economy by playing key roles in the Federal Government’s privatisation and commercialisation schemes. With its global reach, FirstBank provides prospective investors wishing to explore the vast business opportunities available in Nigeria an internationally competitive world-class brand and a credible financial partner.

For six consecutive years (2011 – 2016), FirstBank was named “Most Valuable Bank Brand in Nigeria” by the globally renowned The Banker Magazine of the Financial Times Group and “Best Retail Bank in Nigeria” eight times in a row, 2011 – 2018, by the Asian Banker International Excellence in Retail Financial Services Awards.

Notably, in 2022, the Bank took a long stride on its growth trajectory with the Bank’s Viability and Long-Term Issuer Default Ratings upgraded to ‘B’ from ‘B-‘ (with Outlooks Stable) by Fitch, a leading global rating agency. This is an indication of the Bank’s strong internal capital generation and the corresponding recession of its risks to capitalisation. Fitch also upgraded the Bank’s National Long-Term Ratings to ‘A (nga)’ from ‘BBB (nga)’, to reflect its improved creditworthiness relative to that of other issuers in Nigeria. Furthermore, the Top 100 African Bank Rankings 2022 released by The Banker Magazine revealed FirstBank’s ranking as number one in Nigeria in terms of Overall Performance, Profitability, Efficiency and Return on Risk.

Other laudable feats in 2022 include FirstBank’s international recognition on major indices by Euromoney Market Leaders, an independent global assessment of the leading financial service providers where FirstBank was crowned:

- Market Leader: (tier-1 recognition) in Corporate and Social Responsibility (CSR),

- Market Leader: (tier -1 recognition) Environmental, Social and Governance (ESG),

- Highly Regarded: in Corporate Banking and Digital Solutions,

- Notable: in SME Banking.

Also, in 2022 International Finance Magazine named the Bank “Most Innovative Banking Product in Nigeria” and “Best Retail Bank in Nigeria”. FirstBank was also awarded “Best Corporate Banking Western Africa, 2022” and “Best CSR Bank Western Africa, 2022’’ by Global Banking and Finance Magazine. Other notable awards in FirstBank coffers include: “Best Bank in Nigeria” by Global Finance Magazine – fifteen times in a row; “Best Private Bank in Nigeria-2021” awarded by Global Finance magazine; “Best Internet Banking Nigeria” and ‘’Best CSR Bank Africa’’ by International Business Magazine.

In 2023, FirstBank received notable awards including “Best Private Bank for Sustainable Investing in Africa 2023” by Global Finance Awards; “Best Sustainable Bank in Nigeria 2023” by International Investors Awards; “Best Bespoke Banking Services in Nigeria 2023” by International Investors Awards; “Best Financial Inclusion Service Provider in Nigeria 2023” by Digital Banker Africa; and “African Bank of the Year” by African Leadership Magazine.

Our vision is ‘To be Africa’s Bank of first choice’ and our mission is ‘To remain true to our name by providing the best financial services possible. This commitment is anchored on our core values of EPIC – Entrepreneurship, Professionalism, Innovation and Customer-Centricity. Our strategic ambition is ‘To deliver accelerated growth in profitability through customer-led innovation and disciplined execution and our brand promise is always to deliver the ultimate “gold standard” of value and excellence to position You First in every respect.

Folake Ani-Mumuney

Group Head, Marketing & Corporate Communications

First Bank of Nigeria Limited

DailyrecordNg …Nigeria's hottest news blog

DailyrecordNg …Nigeria's hottest news blog